Marketing budgets are bouncing back. That is the main finding of a variety of studies surrounding the industry, which has been hard hit by the pandemic and a number of other factors.

In fact, marketing budgets claimed only 6.4% of the average company's revenue in 2021. Now, we're seeing this figure jump to 9.5%, according to the Gartner 2022 CMO Spend and Strategy Survey.

A net balance of 14.1% of companies revised their marketing budgets upwards in the first quarter of 2022, according to the latest IPA Bellwether Report. This is the highest it has been since almost eight years ago, in the second quarter of 2014.

Not too shabby. Time to ask your CMO for a little extra moolah for that fancy coffee machine you've had your eye on. The more over-caffeinated you are, the more marketing emails you can send, right? Plus, those beanbags and massage chairs are for when you need to de-stress. Very easily justified to the higher-ups.

In their latest study, Gartner has been asking a bunch of questions about the space. The number one is: following record lows in 2021, how have budgets recovered? Then, it's imperative to determine how CMOs are allocating this newly gained budget.

So, despite a difficult few years, marketing is now seeing the bright light at the end of the tunnel. Despite the IPA warning the industry faces "strengthening headwinds" to its full recovery (including inflation and the war in Ukraine), businesses are feeling "strongly positive" about their budgets for the year ahead. We're a glass-half-full kind of industry, after all.

Budget Increases

- Marketing saw a drop in budget share last year that was unprecedented in recent history, falling from 11.0% to 6.4%.

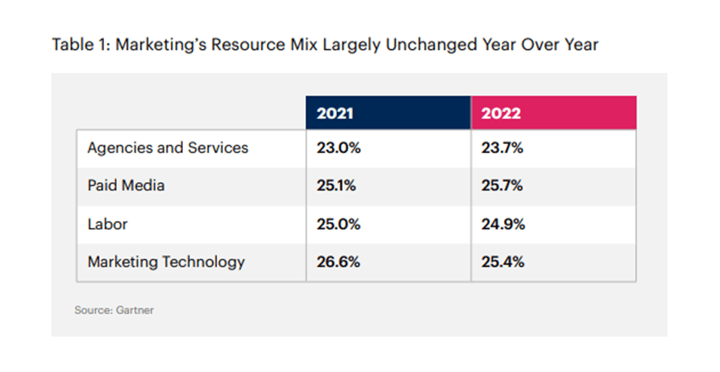

- Marketing technology accounted for the largest portion (26.6%) of marketing budgets in 2021.

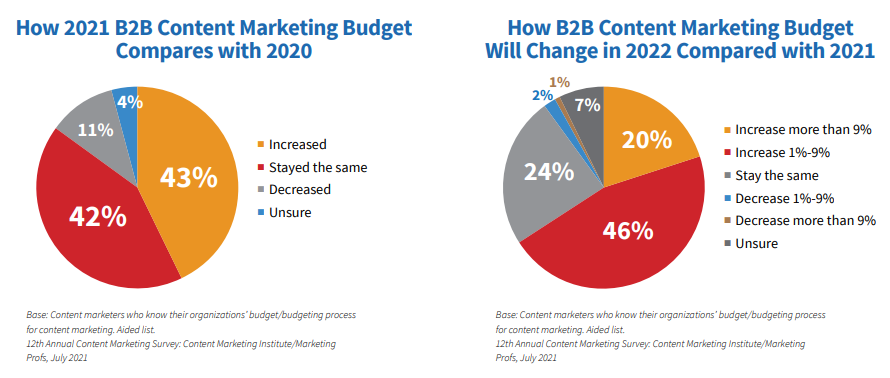

- In the latest B2B Content Marketing Benchmarks, Budgets and Trends report from CMI and MarketingProfs, 66% of respondents with knowledge of their budgeting process (and 75% of the most successful practitioners) expect their budgets to increase in 2022 compared to 2021.

- The net balance of marketers saying they planned to cut spend plummeted to a nadir of 42.2% in the second quarter of 2020.

- While this is a significant uptick, budgets still lag behind pre-pandemic levels — between 2018 and 2020, they averaged 10.9% of company revenue.

- Almost a quarter (24.1%) of surveyed companies upped their marketing spend in the first quarter of 2022, compared to just 10.0% which revised their budgets downwards.

- CMOs’ top three investments were:

- Campaign creation and management (10.1%)

- Brand strategy (9.7%)

- Marketing operations (9.6%)

Category Breakdown

- Events saw the biggest growth in marketing investment over the quarter. A net balance of 18.7% of panellists reported increased spend in the channel, up from -3.9% in Q4 2021.

The further relaxation of Covid measures in the UK “gave businesses the confidence to plan larger-scale gatherings with clients and set up exhibitions”

- Financial services, travel and hospitality, and tech product companies stand out, recording budget increases at 10.4%, 8.4% and 10.1% of company revenue.

- Main media advertising also saw “solid” budget expansion, with a net balance of 9.4% of companies reporting upped spend in this category compared with 3.1% in the previous quarter.

- Online advertising drove growth in this category with a balance of 18.6%, alongside video, which grew to 9.0%, and published brands, which grew to 1.3%.

- Outside main media, sales promotions, direct marketing and PR all saw their budgets grow. A net balance of 8% of companies increased sales promotions budgets (from 0% in Q4), while direct marketing budgets expanded for a balance of 6.0% of companies, up from 3.8%.

- PR saw only marginal budget growth, at a balance of 0.6%.

- Over the last two-quarters of 2021 market research budgets had been in growth, as a balance of 0.7% of companies increased their market research budgets in Q3 2021, and 7% in Q4 2021. However, in the first quarter of 2022 market research saw a net decline of -3.5%.

- B2B respondents outspend B2C when it comes to events, allocating 21.9% of their offline budget compared with 16.4%. The largest area of offline budget spend for B2C is TV (excluding OTT and connected TV), accounting for 16.7%.

- When we asked how CMOs allocate budget to fund brand awareness, engagement and performance marketing, they reported that: 50.1% of their budget is spent on brand awareness and engagement. 49.8% is spent on performance media.

Digital Focus

- Digital channels claim 56% of budgets this year, with social media the top digital channel for spend.

- Paid search and digital display were a close second and third.

- Tech Products, as a category, dropped all the way down to 5% of revenue in 2021, and came back to 10.1% in 2022.

- That was even lower than Travel and Hospitality, which dropped to 5.4% in 2021 and has come back up to 8.4% this year.

- Although online channels take the largest share of 2022 marketing budgets — 56% to be exact — offline channels account for almost half of total available budgets (44%).

- In terms of digital spend, social advertising tops the list, closely followed by paid search and digital display. Social advertising is a logical choice for marketers in 2022, as it continues to offer highly targeted messages at scale.

- One thing to note is that while overall marketing budget shares may have shrunk last year, digital ad spend grew by 30.5%, according to GroupM.

- GroupM projects pure digital advertising to “grow by an additional 13.5% during 2022.”

- The Association of National Advertisers predicts that “display advertising is poised to pull even with search in 2022 and overtake it in 2023.”

- A mid-year eMarketer forecast projected that display advertising was on track for 32.6% growth in 2021, outpacing the healthy B2B digital ad market as a whole.

- Research by Kantar has found that online video ads are the leading source of planned investment increases in 2022, with 76% of marketers expressing an intent to expand media budgets in this area. These top priorities were also revealed by the survey:

- Branded content by influencers

- Ads in social media stories

- Ads in social media feeds

- TV ads streaming on smart TV

- Online display ads

- This year, 57% of US video ad spending will go to linear TV, a decline from 62% in 2021 and 71% in 2020. By comparison, ad spend share is increasing for connected TV (CTV) and other digital formats such as social video

Skills Gap

- In 2022, as in previous years, CMOs are challenged with capability gaps.

- 26% of CMOs consider marketing data and analytics as a top-three capability gap.

- 23% of CMOs include customer understanding and experience management.

- 22% of CMOs cite marketing technology.

- These speak to a larger resource challenge, as 58% of CMOs report that their teams lack the capabilities needed to execute their strategy.

- 51% of marketers agree that avoiding the default to the traditional mindset is one of their biggest struggles.

- 51% of marketers also struggle with staying away from sales-oriented marketing.

- Agency and labour spend are stubbornly static. This is despite in-housing aspirations and expanding marketing accountabilities, with 54% of CMOs reporting that the function is growing in scope

Future Planning

Future Planning

- Most businesses today already spend less than 50% on brand-building

- The IPA warns the industry faces “strengthening headwinds” to its recovery, including inflation and the war in Ukraine.

- A net balance of 33.1% of companies surveyed expected growth in their available marketing budgets for 2022/23.

- The author of the IPA Bellwether, S&P Global, has downgraded its GDP growth forecasts for 2022 and 2023 from 4.0% and 1.8% to 2.8% and 1.2%.

- This slowed growth is expected to negatively impact advertising spend. The IPA has revised down its figures to 3.5% in 2022 and 1.8% in 2023, from 5.2% and 2.5%.

- The IPA is expecting current events to have little impact beyond the next couple of years. Forecasts for GDP and ad spend beyond 2023 are “broadly unchanged” from the last Bellwether report.

- Survey respondents were more pessimistic than they were three months ago about the financial prospects of the industry as a whole, with a net balance of -3.6% of companies reporting less optimism.

- This was broadly unchanged from the fourth quarter of 2021 (net balance of -3.8%) and therefore the second-greatest degree of pessimism for over a year.

- In contrast, when it came to their own businesses, 6.6% of companies were optimistic in their outlook.

- That said, this was down from 7.6% in the previous quarter

This post is part of our Martech stats series, which compiles key data and trends. Others include: