Understanding 2024 Martech Trends for Agency Growth

Graham Charlton | 26 March, 2024

Martech is at the heart of marketing strategy. It’s deeply integrated into nearly every aspect of marketing strategies and operations, to the extent that marketing would be less effective without it.

With marketers now relying on technology to carry out their day-to-day roles, agencies have increasingly built up their martech capabilities.

Agencies are helping marketing teams understand the martech ecosystem, and build and execute the strategy and functions required to use technology effectively.

From an agency perspective, it’s vital to understand key trends in martech to constantly build up their abilities, which enables them to create effective marketing strategies for their clients.

This allows agencies to maintain a competitive edge, foster innovation, and meet the ever-changing needs of both the market and their clients.

In this article, we’ll look at some of the key trends affecting the martech industry in 2024, from the big tech platforms to the broader martech ecosystem - a range of regulatory, technological, and economic issues.

We’ll also look at the key challenges marketers face as they look to make sense of the martech ecosystem and to acquire and use martech more effectively to reach their customers.

Throughout, we’ll also look at the role agencies have to play in helping CMOs address gaps in skills and knowledge, and how agencies are well-positioned to provide solutions to the many issues organisations are facing.

The State of the Martech Industry in 2024

At LXA, we regularly survey and interview agencies, CMOs, vendors and marketing leaders. We also produce an annual State of Martech and Marketing Operations report.

The martech industry is big news. We estimate the martech and salestech industry was worth a massive $669.3bn in 2023. It’s been growing steadily year on year and this growth looks set to continue.

While the industry has experienced strong growth, especially in the period immediately following the pandemic, there has been a correction over the past couple of years, and there is some uncertainty in the market.

This uncertainty comes from three key areas:

- Macro trends. Global tensions resulting from the ongoing war in Ukraine and Gaza as well as economic uncertainty.

- Industry. Key challenges around the loss of data through cookie depreciation and ongoing privacy legislation.

- AI. This has the power to drive disruptive change. Though much of this change is likely to be positive, it will change ways of working and even business models.

As Conor McKenna, Partner at LUMA Partners pointed out in a recent Anticon Dial Up, there are some positive economic signs. Inflation has begun to fall, while market performance has picked up so market uncertainty doesn’t necessarily match economic reality.

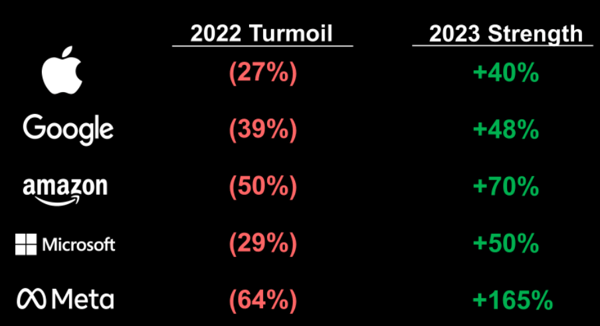

He also points out a dichotomy in the tech ecosystem between the tech giants (Microsoft, Apple, Google, and Meta) and the rest.

These tech giants have recovered from drops in their market caps during 2022, driven by competition, government scrutiny, and changes to business models. The big four, in addition to companies such as Adobe and Salesforce, have produced much stronger performance in 2023.

There are three major reasons for this; improved efficiencies, key advantages around AI, and a greater ability to deal with issues around privacy and antitrust.

The ‘year of efficiency’

The big four were able to create greater efficiencies through streamlining headcount, and slowing the rate of hiring. They also slowed spending on more experimental areas, such as investment in the metaverse.

Growth in revenue from ad tech and AI also contributed to a stronger performance in 2023, with margins now looking much healthier.

Big tech firms hold key advantages around AI

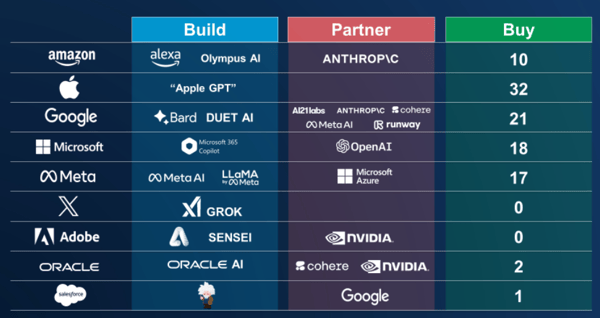

The scale and availability of capital of the big tech firms has given them a key competitive advantage.

They have the ability to invest and build AI products of their own, as Google has with Bard, or to partner with companies as Microsoft has done through its investment in OpenAI. Also, where the knowledge or technology isn’t available in-house, they have deep enough wallets to acquire AI startups.

In addition, they have access to proprietory data sets which can provide a competitive advantage.

Privacy and antitrust

It’s useful to look at these issues as they relate to the rest of the tech ecosystem. In terms of privacy, the tech giants are more positioned to absorb regulatory fines, the capacity to find solutions to data loss, as well as holding vast amounts of first party data.

Antitrust issues such as the US vs Google trial, and the current action against Apple, have highlighted the broader scrutiny and regulatory pressures big tech companies face, which leads to a delicate balance between innovation and market dominance.

This has inhibited the ability of Google and the rest to acquire firms. As the big tech firms are often the major exit route for tech startups, this has dampened down M&A activity.

How do these issues affect the tech ecosystem?

Turning our attention to the rest of the tech ecosystem, we see three major issues; a forced shift to profitability, greater difficulty raising capital, and fewer exit routes.

Shift to profitability

A sudden shift towards greater profitability is easier for the big tech giants, which were already highly profitable.

For the rest of the match ecosystem, this was much more of a challenge and required more fundamental change, namely from a growth-driven model which wasn’t necessarily profitable.

Now, tech startups need to be able to show profitability early on, something that many businesses have managed to do.

Lack of venture capital

Tech startups, working and innovating to create new products, need capital. It’s this capital that allows them to take risks, experiment, and innovate.

Now, with venture capital less readily available, investors are focusing on key metrics of profitability and capability. This has led to greater numbers of tech startup failures than we’ve seen in the past few years.

Fewer paths to exit for tech startups

The antitrust issues we touched upon earlier have reduced the number paths to exit for tech startups.

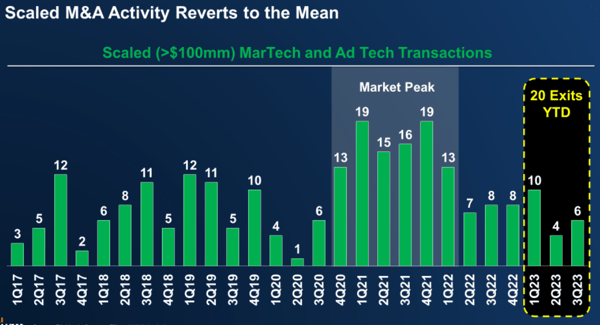

As Conor told LXA, M&A activity has been undergoing a sustained lull over the past two years. Indeed, 2023 was the lowest year in terms of M&A volume in the last decade.

IPOs are another key exit route, and we’ve seen fewer in 2023, with just three scaled IPOs tracked by Luma. Reddit’s IPO is on the horizon though, and is expected to be worth $6.4bn.

There are certainly a number of challenges faced by the broader martech ecosystem, but there is also some room for optimism.

Basically, the underlying fundamentals driving martech are still strong - digital ad spend, ecommerce, and software spending are all experiencing continued growth - our own data, reference later in this article, finds CMOs planning martech budget increases.

The long-term market perspective

If we look at the market over a longer period, this puts the ‘peak’ period between 2020 and 2022 into perspective.

During the ‘growth at all costs’ period in 2021, during which growth was by far the most important valuation metric for software businesses, we were seeing higher value to revenue multiples for both martech and adtech acquisitions - often as high as 20x revenue for martech.

If we look at this over a ten-year period, the declines of the last 12-18 months can be viewed as a reversion to the historical averages, with valuations roughly around 4 to 5x revenue.

Moreover, this downward movement in terms of valuation has stabilised, and we now see revenue multiples remaining at the same level, essentially reverting to the mean.

The reason for this is the change of focus towards sustained profitability. So we see that, while revenue growth has slowed, margins have improved.

As Conor puts it, where Meta had a year of efficiency, the wider tech ecosystem has now entered an era of increased efficiency, prioritising efficient and profitable growth.

This can be seen in the volume of martech M&A activity, with Luma tracking just 20 scaled tech exits in 2023.

There is reason to believe that, having reverted to the mean, M&A activity and exits will remain at a similar level for at least the near future.

The big tech giants are less likely to buy due to antitrust concerns, while marketing clouds have slowed down their acquisition strategies, generally moving from smaller to mid-scale acquisitions to bigger deals with more transformative potential, such as the $27.7bn Salesforce acquisition of Slack.

According to LUMA, M&A activity in the near term may be driven by private equity, as well as the group of martech companies with valuation above the $1bn mark. These companies may have chosen to build rather than buy in the past, but in this era of efficient groth, M&A becomes a more attractive growth lever.

Key trends affecting the martech ecosystem

Some of the biggest issues that are affecting the martech ecosystem are the challenges around data, the continued growth of digital commerce, the desire to provide omnichannel customer experience, and trends around the martech stack.

Data and identity

Legislation around data use has been introduced in many countries worldwide, with more on the way. This means marketers have to consider legal compliance issues wherever they collect and use customer data.

It’s therefore no surprise that 65% of organisations surveyed by LXA fo our State of Data Privacy report admit that they find dealing with changes in data privacy regulations a challenge.

The data privacy regulatory environment has expanded over the last decade and is still growing.

Following the introduction of the General Data Protection Regulation (GDPR) in 2018, other countries have followed suit, with the US introducing the California Privacy Rights Act (CCPA) and the USA’s Children’s Online Privacy Protection Act (COPPA).

According to the United Nations Conference on Trade and Development, 183 countries now have data protection and privacy legislation, while 20 further countries have draft legislation in the pipeline.

While data regulations and enforcement may vary between countries, a common theme is that these regulations seek to empower consumers by enabling them to control what data is held about them and to consent to the sharing of data.

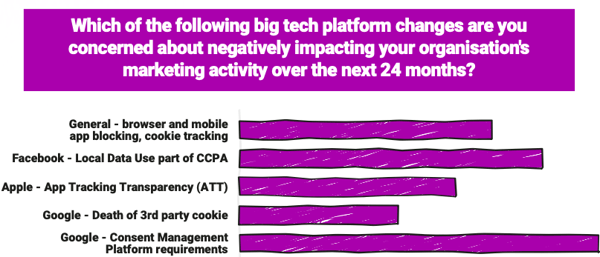

Tech platforms have responded to these regulations with tighter controls around privacy, with Apple, Google and Meta making changes that impact marketers and advertisers, most notably Google’s phasing out of third-party cookies.

The direction of travel is clear, and the result is a shift from a third-party to a first-party world, where the pros and cons of each are reversed.

While third-party data offered the benefits of scale, greater supply, and ease of use, drawbacks included trustworthiness of data, control, and consumer privacy.

In a first-party data world, this is flipped around so that, while data may be harder to find, the data they have is more trustworthy, consumer privacy is protected, and brands ‘own’ this data.

This drives the need for solutions for targeting, which explains the rise of Data Clean Rooms and other cookieless solutions, as well as the need for cookie-less and non-audience solutions.

While these may be being tested by some companies, the majority of marketers may wait until the 11th hour to fully implement these solutions.

Also, many marketers may prefer to see what the industry as a whole does to deal with this challenge before acting themselves.The result is that not all organisations are confident that they are in a position to cope with the death of the third-party cookie.

Digital Commerce

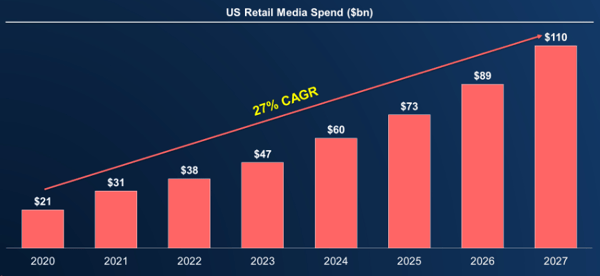

Digital commerce continues to grow, with new channels such as mobile, social commerce and commerce media helping to support this growth.

One key area of growth in commerce media or retail media, which uses first-party consumer data from retailers to target shoppers who are likely to purchase, offering a direct link to transactions.

Brands use retail media advertising to improve visibility on retail websites and target potential customers, while agencies assist in managing retail media initiatives.

The adoption of retail media is driven by four factors:

- Retailers looking for new revenue.

- Marketers looking for improved attribution.

- The ecosystem looking for solutions for the lack of data.

- Consumers who spend more time on commerce channels.

The omnichannel experience

Over the past decade, the digital marketing ecosystem has been moving towards managing omnichannel customer experiences.

Martech vendors may have started out in specific channels - email, ecommerce etc - but there’s now an increasing overlap, and they expand to cover more customer touchpoints.

The result is that many vendor pitches sound very similar, each using language around omnichannel marketing and engagement, and a focus on the customer.

This drive towards multichannel has led to the growth of CDPs, and an evolution of company interaction with customers across channels.

At the same time, the customer journey is growing more fragmented and complex, with customers using more and more touchpoints.

For this reason, social commerce has been a major focus for the large tech platforms over the last year, with TikTok launching Shop and Amazon making partnerships with platforms like Meta, Snap, and Pinterest. Last year, there were more than 100mm social commerce buyers in the US.

Conversational commerce is another growth area, and messaging offers the potential for marketers to bridge existing gaps in omnichannel, between third party and first party owned platforms.

The martech stack

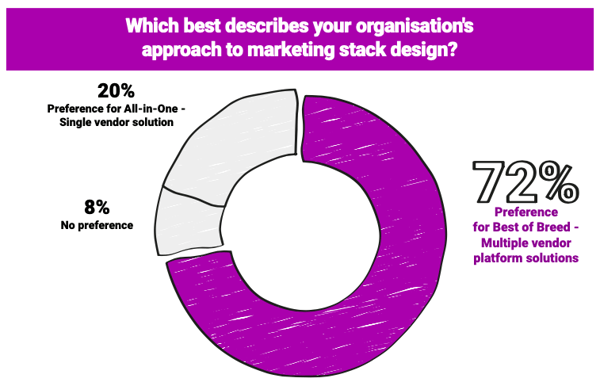

For some years, we've seen a push and pull between martech suites, in which one vendor provides a range of features, and the ‘best of breed’ approach, whereby organisations build their stacks by picking and choosing the best tools for each use case.

The momentum is moving in the direction of ‘best of breed’, with 72% of CMOs surveyed by LXA expressing a strong preference for this approach, which partly explains the number of tools (56) in the average tech stack.

This drives the trend towards composability in stack design, whereby marketers can combine powerful capabilities from best-of-breed solutions, and gain the flexibility of swapping out key elements to add capabilities and adapt to changing business needs.

Composability has its own challenges though. Integrations can take time and don’t always operate smoothly, so the ability of vendors to provide apps which play well with other solutions has become vital.

As Henk-jan Ter Brugge, Head of Martech at Philips points out, vendors are beginning to adapt:

Vendors have adapted to the trend toward composability to some degree, with many developing robust, open APIs that enable their solutions to connect with third-party tools - those long-tail solutions referred to by Scott Brinker.

We will move to a (mar)tech ecosystem that is more plug and play. With democratisation of martech capability, and current inefficiencies and pressures on budgets, there will be a drive for more capability-focused tech. It may take ten years, but we will go to a place where you buy use case execution, like an app store.

AI

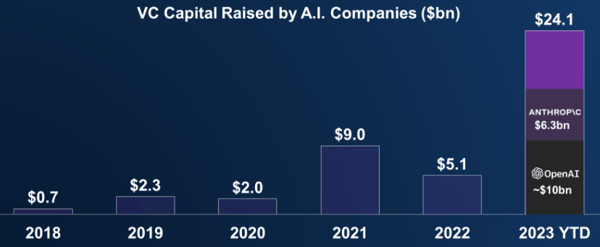

Artificial Intelligence (AI) is nothing new, but the last 12 to 18 months have seen huge growth in adoption, as well as VC capital heading to AI startups.

AI has also driven increased returns for the big tech companies. For example, Nvidia, which dominates the AI chip market, has grown from a $350 billion company at the start of 2023 to a valuation of $2.2 trillion.

The ‘Magnificent 7’ (Apple, Google, Meta, Microsoft, Tesla, Nvidia, and Amazon) have driven a 14% gain in the overall market in 2023 YTD, all tied in with AI.

While AI has game-changing potential, as a recent discussion with Scott Brinker explored in detail, there has also been hype. Lots of tech vendors are bigging up the AI elements in their tools, and tech startups are wise to mention AI if they want to attract funding.

The pace of development around AI, particularly around generative AI tools such as ChatGPT, means that the technology has moved way ahead of legislation and governance.

For example, marketers using content generated by ChatGPT or similar AI tools may find in the near future that they have been breaking copyright laws, depending on the data sets used.

We’re now seeing regulators attempting to catch up and regulate AI in key areas. The EU AI Act, and the US government’s proposed AI Bill of Rights are both in progress, and designed to provide some control over the development and potential uses of AI.

Balancing risk and reward in AI will involve a combination of ethical considerations, risk management, transparency, regulatory compliance, and continuous monitoring, while still looking to use AI to improve efficiency and enhance marketing capabilities.

For marketers who can do this, AI can improve efficiencies, improve data gathering and speed to insights, and allow marketing functions to become more effective.

Martech: The CMO view

Marketers now see martech at the centre of marketing strategy, which is why CMOs are now spending a greater proportion than ever of their budgets on technology.

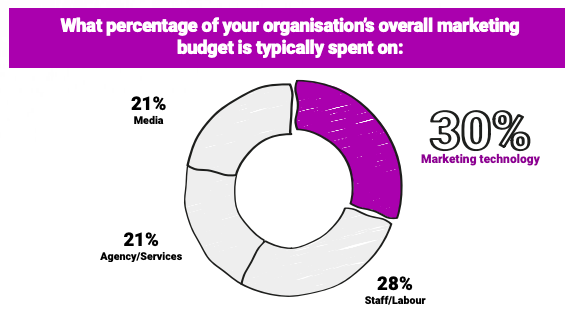

Marketing technology spending now accounts for 30% of marketing budgets, up from 24% in 2022. Labour costs have dropped compared to last year, from 35% to 28%, a consequence of the new era of efficient growth.

The majority (83%) of CMOs surveyed by LXA last year expect to increase martech spending in 2024, with an average budget increase of 11%. This is good news for martech vendors, as well as agencies selling services in these areas.

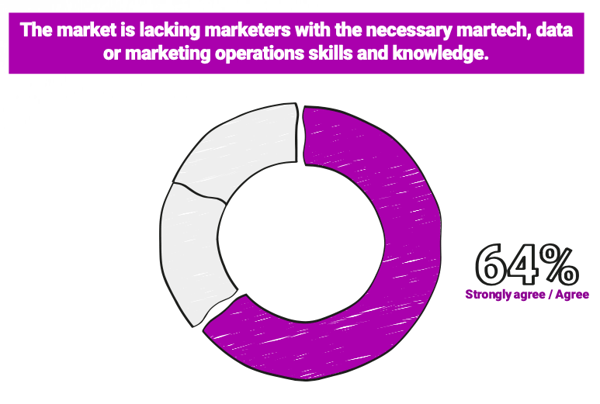

While 63% of CMOs are looking to increase team sizes, they face a challenge in finding the right people, with a lack of available martech and marketing operations talent.

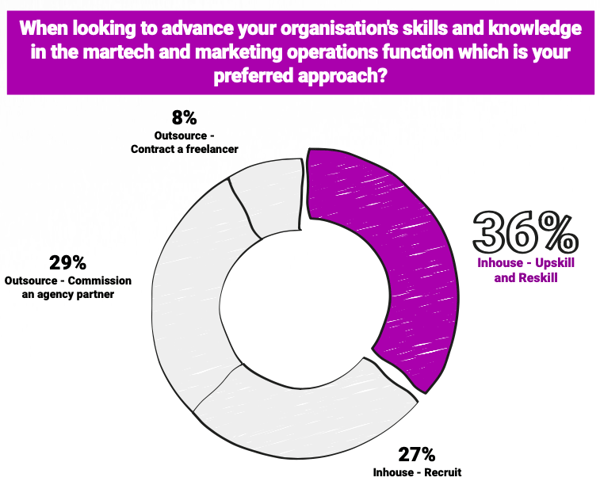

So how can CMOs solve this issue? There are a range of possible answers to this. There is a preference for keeping it in-house, either by hiring new talent or upskilling and reskilling current team members. This is a more sustainable approach, which explains this preference.

There is also a role for agencies to play. It’s about creating that marketing team with the right capabilities, and CMOs will often use a mixture of in-house talent, investment in training, and agency partners to achieve their martech goals.

Key challenges around martech

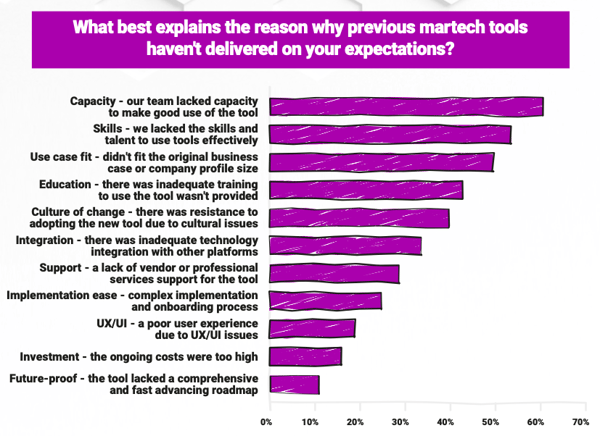

The table below outlines some key challenges CMOs face, which are also some areas where agencies can step in to provide support.

- Team capacity/skills. As we’ve previously touched upon, organisations need more people with the right skills, so they have the capacity to use martech tools, and to use them well.

- Use case fit. You can acquire a great piece of tech, but if it isn’t selected to meet a specific business need, it won’t deliver ROI. This is where marketing enablement is so important.

- Education. There is a need for training and constant upskilling to enable marketers to understand and use tech, and to keep on top of changing demands.

- Integration. With CMOs preferring a best-of-breed approach, and the average tech stack comprising 56 tools, integration is an ongoing issue.

- Support/implementation. CMOs need post-purchase support from vendors to ensure smooth implementation, while this is another area where they may draw upon agency expertise.

Essentially, there are a range of reasons, which means CMOs are not always capitalising on their martech investments. These issues can be addressed through improved governance, delivered through marketing enablement, an area where agencies can provide support.

Which tech tools are CMOs investing in?

Based on our research and surveys from our Anticon events, these are the to tools on most CMO’s shopping lists.

One theme common to many of these tools is data (CDPs, analytics & attribution etc). The modern marketing stack depends on first-class data practices - collecting, organising, analysing, and protecting data to unleash its true potential.

Data forms the foundation of a robust tech stack, enabling users to deliver those personalised experiences, to optimise campaigns, to access insights, to manage workflows efficiently.

One tool not mentioned here, but one we think will become more important in 2024, is the Data Clean Room.

One consequence of the move towards the first-party data approach we mentioned earlier is the need to address the drawbacks, such as lack of scale and ease of use.

Data Clean Rooms allows walled gardens like Facebook and Amazon to share aggregated rather than customer-level data with advertisers, while still exerting strict controls. It’s a solution which potentially allows advertisers to access data at scale once third party cookies have finally been phased out.

Google has officially blocked cookies for 1% of Chrome, and we currently expect this to reach 100% by the end of 2024, though few would bet against a further delay.

This means that how organisations target individuals has to change, and data clean rooms are potentially the answer for many.

One sign of where things are heading is LiveRamp’s $200m acquisition of clean room specialists Habu.

AI mania

AI was everywhere in 2023, and adoption will continue into 2024. For the most part, the hype is justified, as it has game-changing potential for marketing stacks.

CMOs are bullish about AI, with 73% believing that it will improve both the efficiency and effectiveness of marketing over the next two years. For this reason, 74% of CMOs are piloting, or looking to pilot, initiatives around AI and ML in the next 24 months.

AI isn’t simply about future potential. It’s available here and now for many marketers, either improving the capabilities of existing tech tools, or through new tools providing copywriting, predictive analytics, and improved personalisation.

As we explored in our Marketing Capabilities Excellence guide, AI is one of the most in-demand areas where companies are looking for training at the moment (which is why we offer AI-enabled marketing training).

Marketers need to improve AI strategies, building specialist teams which enable them to harness AI effectively and directly impact marketing performance using tools and techniques which are available right now.

Agencies are also looking to boost their capabilities in this area, with WPP and Publicis both investing hundreds of millions into AI initiatives.

The average marketing stack already contains AI in many areas, but this will become smarter, faster, and more powerful than ever.

The potential of AI is massive, and marketers and agencies will be focusing on the best ways to harness this power.

Summary: the role of agencies in martech

One key agency trend over the past few years has been the development of their own skills, knowledge, and capabilities around martech.

Several bigger agencies have been acquiring smaller companies specialising in martech and digital marketing to augment their own offerings. For example, WPP acquired Bower House, while Publicis acquired Yieldify recently.

As Laura Merten, Martech Solutions Architect at Hogarth Worldwide told LXA, agencies with the right expertise will become more valuable as martech continues to grow:

Clients are investing a lot in building their Martech stacks, but the users are typically very busy, having to learn 40+ Martech systems and keep up with increasing demands of personalisation. Because of this, clients are asking agencies to step in to help augment their marketing operations teams and also help them make the most of the martech platforms.

As organisations look to become fully digital, a process in which marketing technology is central, agencies that can offer this expertise in digital strategy and martech will become increasingly important.

Despite some market challenges, the overall martech continues to grow, driven by demand from marketers for the tech that enables them to provide customer experiences that differentiate them from the competition.

The big challenge marketers face is the lack of skills and knowledge around martech, and the processes and governance which enable them to build sustainable marketing capabilities.

With many CMOs preferring to hire new staff or upskill their in-house teams, training will be the key solution. Agencies too, require the training and upskilling which enables them to improve their own client offerings - this is why WPP has introduced its own martech academy.

With multiple opportunities for agencies to provide their expertise around martech, and to help CMOs build and improve marketing enablement, the immediate future looks bright for those agencies that have doubled down on martech.