The global AI market is projected to reach $190.61 billion by 2025, with an estimated 8.4 billion AI-powered digital assistants expected to exist by 2024, surpassing the global population. The pace of advancement in AI is fascinating yet challenging to keep up with.

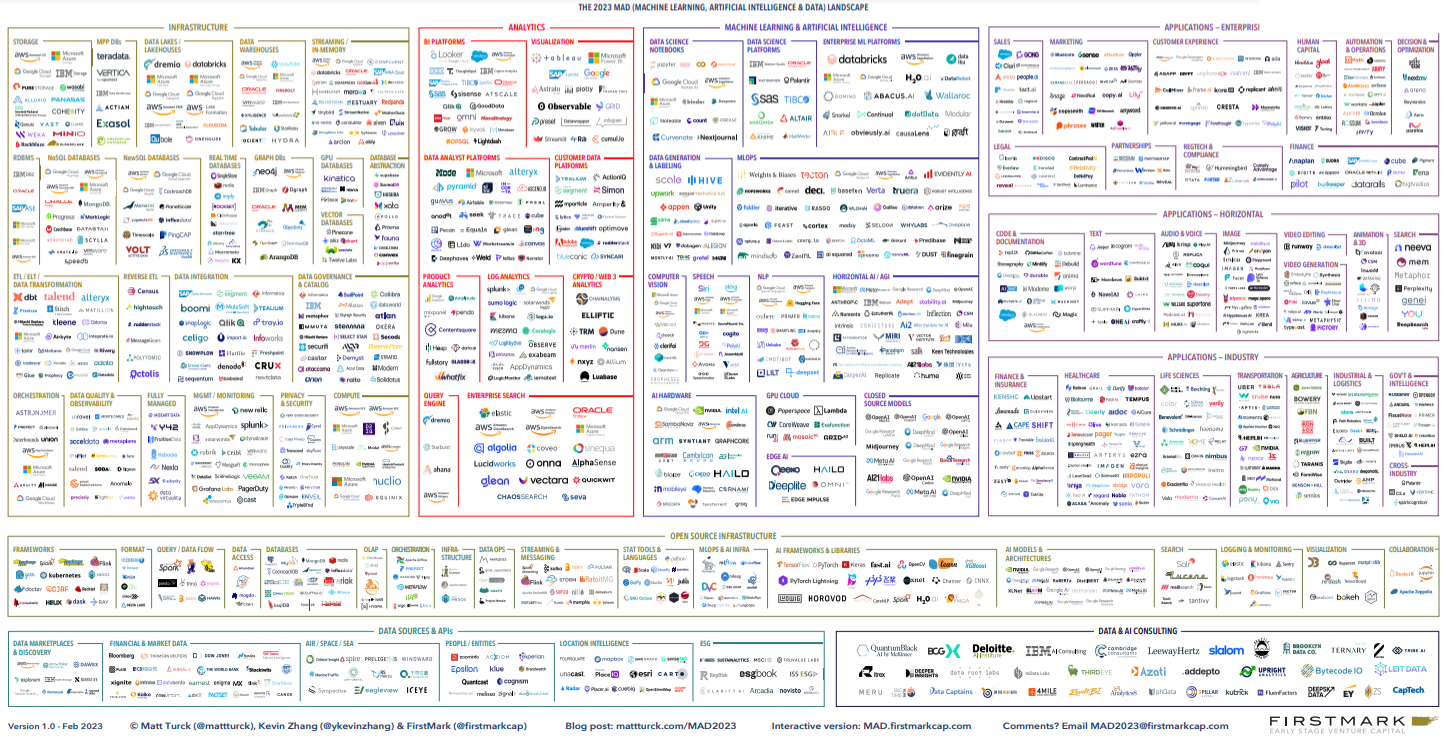

The annual MAD (Machine Learning, Artificial Intelligence, and Data) landscape serves as Matt Turck's endeavour to comprehend this dynamic field. Its philosophy is to share the work and engage in discussions with the community. This year's edition was co-authored by Katie Mills, Kevin Zhang, and Paolo Campos.

In recent months, there has been an undeniable and exponential acceleration of Generative AI, leading to the formation of a new mini-bubble. The impact of AI has extended beyond just technological progress and has become a mainstream phenomenon, with non-technical individuals worldwide experiencing its power firsthand.

The rise of data, machine learning, and AI is one of the most significant trends in our generation, with far-reaching implications beyond technical domains. Its impact on society, politics, geopolitics, and ethics is profound.

Its impact on our industry will be huge, with phrases such as AI marketing, AI sales, and AI content becoming natural parts of our daily vocabulary this year and last.

Interested in hearing more? Then head on over to our free AI-Driven Growth Best Practice Guide. In this report, we explore the growth and evolution of AI, examining some of its potential uses, especially in marketing, sales, and customer experience.

So, let's jump in.

Top Major trends in MAD for 2023

MAD companies facing a new recessionary era

The 2023 MAD (Machine Learning, Artificial Intelligence, and Data) landscape is facing a new economic era where capital has become scarce and expensive. As a result, companies in this space have had to shift their focus from growth at all costs to controlling their expenses. Layoff announcements have become a common occurrence, as many companies on the 2023 MAD landscape have had to reduce their workforce.

However, despite the challenges, the market demand for software products in this space has started to adjust to the new reality. As a result, many previously hidden or deprioritised issues have now emerged in full force, and everyone is paying more attention. Venture capitalists on boards are less focused on chasing the next shiny object and more concerned with protecting their existing portfolios.

Frozen financing markets

The financing markets have been largely shut down in 2022, affecting both public and private markets, and the trend is expected to continue into 2023.

The market conditions have led to a situation where only companies with sustained growth and favourable cash flow dynamics will be separated from companies that have relied heavily on capital. The IPO window has been closed, with no clear indication of when it will reopen. The overall IPO proceeds have decreased by 94% from 2021, while IPO volume has declined by 78% in 2022.

Generative AI, a new financing bubble?

Despite the general downturn in the market, Generative AI has emerged as a bright spot in the tech industry. Due to its potential to bring about a major shift in the technology landscape, VCs have been investing aggressively in the space.

Several AGI-type companies have raised over $100 million in their first rounds of financing, with founders from research labs like OpenAI, Deepmind, Google Brain, and Facebook AI Research attracting significant investments. Notably, OpenAI received a $10 billion investment from Microsoft in January 2023, while other AI-powered platforms like Runway ML, ImagenAI, and Descript have also raised substantial amounts of financing.

AI goes mainstream

The release of Open's AI conversational bot, ChatGPT, on November 30, 2022, marked a significant moment in the mainstreaming of AI. ChatGPT, which has the ability to mimic human conversation, quickly became one of the fastest-growing products ever. Its release based on GPT 3.5 signifies that AI has become a significant aspect of collective consciousness.

The exponential acceleration of Generative AI

OpenAI has played a significant role in advancing AI image generation technology. In early 2021, it released CLIP, an open-source, multimodal, zero-shot model.

The model can predict the most relevant text description for an image given its text descriptions, without optimizing for any specific task. OpenAI also launched DALL-E, an AI system that can generate realistic images and art from natural language descriptions.

Its second version, DALL-E 2, was released publicly in September 2022. In the same month, OpenAI released Whisper, an automatic speech recognition (ASR) system capable of transcribing and translating multiple languages into English. MetaAI also released Make-A-Video, an AI system that generates videos from text in September 2022.

The inevitable backlash

The immense power of generative AI has led to several concerns, including fears that it will replace human jobs.

However, it is more likely that we will move towards a co-working model where AI models work alongside humans as "pair programmers" or "pair artists." There is already a marketplace for selling high-quality text prompts called Promptbase.

There has been some misuse of Generative AI, including the creation of an NSFW porn generator, Unstable Diffusion, which was shut down on Kickstarter. Additionally, some organizations have banned ChatGPT, and Microsoft/GitHub is facing a lawsuit for alleged IP violation when training CoPilot, accused of killing open source communities.

Finally, there are also allegations of exploitation of Kenyan workers involved in the data labelling process.

Who are the key players in MAD?

This year's landscape features a total of 1,416 logos, compared to 139 in the first version from 2012. The focus this year is on featuring more very young startups, including those in new areas like Generative AI.

The report states that when IPOs become possible again, the biggest private companies will need to go out first to open the market. Databricks, which raised at high valuations and has an ARR of over $1B, is a likely candidate. While the company is reportedly preparing for a potential listing, CEO Ali Ghodsi has expressed no particular urgency to go public.

- Funding for startups dropped 31% compared to 2021, with the growth market taking a particularly hard hit. Although there were a few funding announcements in the first half of 2022, they slowed down significantly in the second half of the year.

- Despite a difficult year for acquisitions in 2022, there were still several large deals. Notable examples include Illumina's acquisition of Grail for $7.1B and BioNTech's acquisition of InstaDeep for ~$682M.

- Databricks has been expanding its product line to cover a wide range of MAD landscape categories, including data lake, streaming, data catalogue, query engine, data engineering, data marketplace, data sharing, and data science/enterprise ML. This has been done mostly through organic growth, with a small number of tuck-in acquisitions like Datajoy and Cortex Labs.

- InfluxDB secured $51M in Series E funding in Feb 2023, Anduril raised $1.5B in Dec 2022, Dataiku raised $200M in Series F at a $3.7B valuation, Alation raised $123M in Series E at $1.7B valuation, and Horizon Robotics secured $1B in Oct 2022.

- Several major acquisitions took place, including Illumina's $7.1B acquisition of Grail, a company that uses machine learning for cancer detection; Snowflake's $800M acquisition of Streamlit, a platform for creating shareable web apps from data scripts; and BioNTech's acquisition of InstaDeep, an AI decision-making platform, for approximately $682M at the beginning of 2023.

What were the key takeaways from last year?

The 2021 Machine Learning, AI and Data (MAD) Landscape report by Matt Turck provides a comprehensive overview of the current state of the industry and highlights several key takeaways:

- The continued growth of the AI and Machine Learning industry: The report highlights that the AI and machine learning industry continues to grow at a rapid pace, with increased investment, new startups, and advancements in technology.

- The emergence of new tools and platforms: The report highlights the emergence of new tools and platforms, such as low-code and no-code platforms, which are making it easier for non-experts to build and deploy AI and machine learning models.

- Increased focus on privacy and ethics: The report notes that there is an increased focus on privacy and ethics in the AI and machine learning industry, as stakeholders seek to mitigate the risks of biased algorithms and protect the privacy of individuals.

- Growth in the use of AI and machine learning in healthcare: The report highlights the increasing use of AI and machine learning in healthcare, with applications in areas such as disease diagnosis, drug development, and personalized medicine.

- Advancements in natural language processing (NLP): The report notes that there have been significant advancements in NLP, with breakthroughs in areas such as language models, sentiment analysis, and machine translation.

- Growth in the use of AI and machine learning in cybersecurity: The report highlights the increased use of AI and machine learning in cybersecurity, with applications in areas such as threat detection and network security.

The future outlook for MA

Key trends in the data infrastructure market for 2023 suggest a crowded and competitive landscape, particularly as customers face increasing budget pressure and CFO control. While data and AI remain a priority for many businesses, they must now do more with less and are therefore more likely to choose established vendors that offer tightly integrated suites of products that "just work."

As the market becomes increasingly Darwinian, the most successful companies will find ways to grow and expand their offerings from a single feature to a comprehensive platform. This growth will require deepening their customer relationships, particularly as the market faces pressure to rationalize and streamline costs.

Over the last few years, the "Modern Data Stack" (MDS) has been a hallmark of the data infrastructure market, providing a growing and cooperative world of possibilities for businesses. However, recent changes to the market suggest that the MDS may be under pressure as businesses seek to control costs and rationalize their approach to data infrastructure.

Despite the challenges facing the data infrastructure market in 2023, there are still many opportunities for businesses to succeed. This includes vertical-specific or task-specific companies that intelligently leverage Generative AI, AI-first companies that develop their own models for non-generative tasks, and LLM-Ops companies that provide the necessary infrastructure to support these solutions. By focusing on these areas of opportunity, businesses can stay ahead of the competition and thrive in the evolving data infrastructure market.